For the past three decades, the playbook was simple: design in North America, manufacture in Asia, ship worldwide. Labor costs were dramatically lower overseas. Container shipping was cheap and reliable. The math was obvious.

That playbook is broken.

Tariffs have rewritten the cost equation. Supply chains have proven fragile. Lead times have stretched from weeks to months, and sometimes to "we'll let you know." The pandemic showed us what happens when a single factory closure in Shenzhen ripples through global supply.

Canadian manufacturers are responding. More companies are bringing production home. This is a hard-nosed business calculation rather than a patriotic one. Here's why.

The New Tariff Reality

Trade tensions have transformed the landed cost of imported goods. What used to be a 20-30% cost advantage for overseas manufacturing has shrunk or disappeared entirely for many products.

When you factor in duties, you need to recalculate whether offshore manufacturing still makes sense. For many product categories, it doesn't, especially when you consider the hidden costs.

Hidden Costs of Offshore Manufacturing

- Tariffs & duties: Often 15-25% on finished goods

- Shipping costs: Container rates remain volatile

- Inventory carrying: 12-16 week lead times = more cash tied up

- Quality issues: Defects discovered after delivery

- Communication overhead: Time zones, language barriers

- IP risk: Designs can leak to competitors

The Supply Chain Security Premium

Beyond cost, supply chain reliability has become a strategic priority. Companies that couldn't get parts during COVID disruptions learned expensive lessons about single-source dependency.

Domestic manufacturing provides:

- Shorter lead times: Days instead of months

- Responsive communication: Same time zone, same language

- Quality visibility: You can visit the facility

- Flexibility: Changes don't require trans-Pacific coordination

- Reduced inventory: Shorter lead times = less stock needed

Many companies now view domestic manufacturing as insurance, worth a premium even if unit costs are slightly higher.

When Canadian Manufacturing Makes Sense

Not everything should be made in Canada. But more products qualify than many realize:

Low-to-medium volume production

The cost gap between domestic and offshore narrows dramatically for runs under 10,000 units. Tooling amortization, shipping, and minimum order requirements often make small batches cheaper to produce locally.

Products that change frequently

If you're iterating quarterly or responding to customer feedback, the communication overhead of offshore manufacturing becomes significant. Local production lets you turn changes around in days.

Time-sensitive orders

If your customers expect fast delivery, 12-week lead times from Asia don't work. Canadian manufacturing enables short lead times and responsive restocking.

Critical components

For parts that can shut down your production line if they're unavailable, supply chain security justifies higher unit costs. Defense, healthcare, and infrastructure buyers increasingly require domestic sourcing.

Products marketed as Canadian-made

"Made in Canada" carries marketing value with certain customer segments. It's particularly relevant for government procurement, institutional buyers, and consumers who prioritize local products.

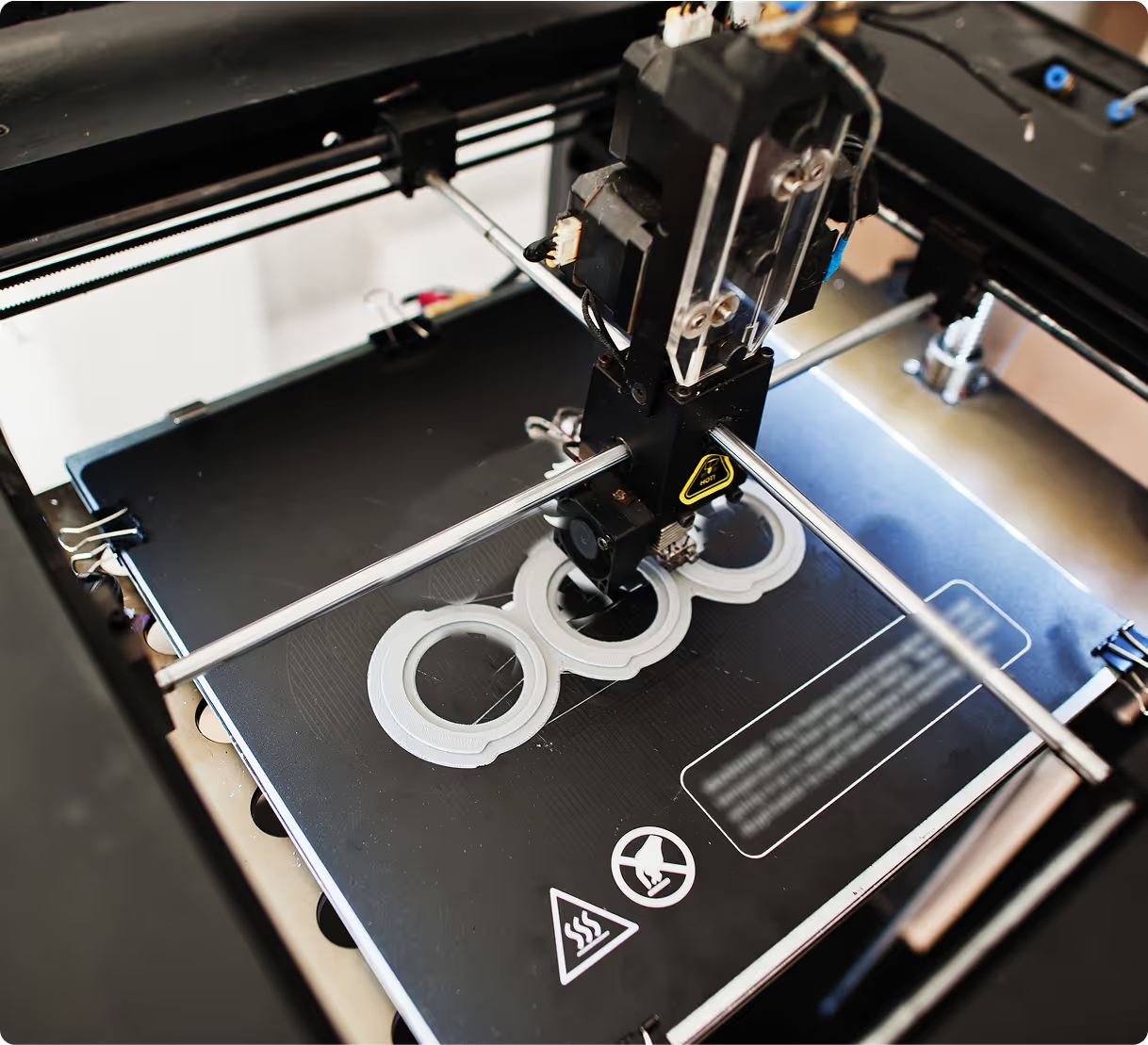

The 3D Printing Advantage

Additive manufacturing amplifies the case for onshore production:

- No tooling: Eliminates the capital barrier to domestic production

- Low minimums: Economical runs start at 1 unit

- Fast turnaround: Most orders ship in 2-5 days

- Design flexibility: Changes cost virtually nothing

- Distributed manufacturing: Produce where you need it

For the right products, 3D printing makes Canadian manufacturing both competitive and advantageous. You get the benefits of domestic production without the traditional setup costs.

"We moved production from China to Victoria and our total costs actually went down. No more tariffs, no more 3-month inventory buffer, no more quality surprises. And when we needed to change a part, it happened in 48 hours instead of 8 weeks."

– BC-based equipment manufacturer

Making the Transition

If you're considering bringing production back to Canada, here's a practical approach:

- Calculate true landed cost: Include tariffs, shipping, inventory carrying, and quality costs, rather than only the unit price

- Identify candidates: Start with components that are small, complex, or frequently changing

- Test before committing: Run a pilot production batch domestically to validate costs and quality

- Phase the transition: Move production incrementally, maintaining backup sources

- Design for the process: Parts optimized for 3D printing or local CNC may cost less than direct translations of injection-molded designs

The Bottom Line

The economic case for offshore manufacturing has weakened. Tariffs, supply chain risk, and hidden costs have narrowed the gap. For many products, especially those with moderate volumes, frequent changes, or critical applications, Canadian manufacturing now wins on total cost.

Add in supply chain security, marketing value, and the ability to respond quickly to market changes, and the case for bringing production home has never been stronger.

Contact us to discuss your manufacturing requirements, or get a quote for Canadian-made parts.